Nigeria is passing through a hard time at the moment. The economy is dwindling and the market is not smiling. Poverty and unemployment rate is on the high side and sky rocketing. Fuel scarcity has become a reoccurring decimal and the dollar is continuously putting pressure on the Naira, while the sale from crude oil is no more enough to fund the federal and state governments.

Also, the drop in foreign reserves, which have fallen to below $28 billion have compelled the Central Bank of Nigeria to adopt stringent Forex measures which include the ban of certain items from accessing Forex through the official window of the market and the rationing of Forex for eligible items. The economic is totally on the brink of collapsing. Low oil prices are battering Nigeria’s export-dependent economy, but it’s the government’s market-distorting response that risks pushing the country into economic recession.

For instance, the federal, states and local governments, for the month of January shared N370.4 billion at the Federation Account Allocation Committee (FAAC) meeting, compared to N387.8 billion it shared the previous month. Relative to the N629 billion shared in January 2015 and N503.6 billion in December 2014, it showed that FAAC allocations in one year have almost been halved due to lower earnings from crude exports.

The directive by the Central Bank of Nigeria to make commercial banks stop customers from using their debit and credit cards overseas is one that has serious repercussions and should be reversed. The cutting of $10,000 to $5,000 cash or negotiable instruments across the nation’s borders for travelers with genuine business going abroad is also unacceptable. These policies have put lots of people out of job and crippled the economy more.

Some of the steps taken by the government on the economy which financial bodies such as the Financial Times magazine in the UK has described as foolishness was the intention of the Nigeria government to copy Venezuela’s exchange rate policy and China’s failed equity market strategy. These measures by the two communist nations failed them and Nigeria can’t afford to go such a way in reviving the economy in order to avoid a recession.

(adsbygoogle = window.adsbygoogle || []).push({});

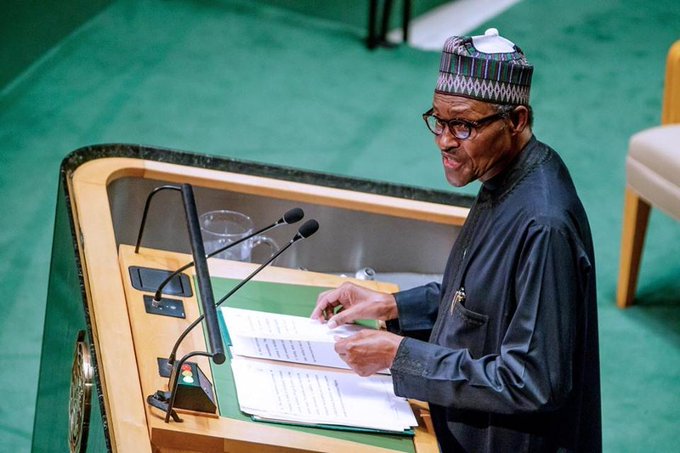

At this juncture, the Buhari government needs to rise up to the challenge of rebuilding the nation. We are anxious to see a positive change that will begin to impact on the day-to-day life of Nigerians. The trial of those alleged to have misappropriated the nation’s wealth; must be concluded in earnest. We should be able to get such looted funds back into the economy so that we can begin to focus on more positive things that are also happening in our nation and can foster socio-economic stability and growth. The economic and financial crimes commission (EFCC) and other graft agencies as well as the courts must work hard to bring the looters to book and recover the stolen wealth.

Programmes such as the Conditional Cash Transfer and renewed support for Micro, Small and Medium Enterprises (MSMEs) should be springing up. These will greatly generate employment, address poverty, and reduce social tension and criminality across the country. The proposed budget recently presented to the National Assembly which was padded must be reworked and when the budget provisions has been passed, it should be strictly followed and properly monitored so that we get the required results. The recent pronouncement that an economic conference will be convened soon is also welcome and the issues should be adhered to while bringing out the desired goal that will improve the lives of common Nigerians. Thank God oil prices have started bouncing back.

This government which had enjoyed so much goodwill from Nigerians home and abroad as well as the international community, should not be seen moving at slow pace, in our interest and that of the unborn generations. The masses are suffering and are almost losing hope in this government. The time to act is now.